Debt Protection with Life Plus

Help protect your family against the unexpected.

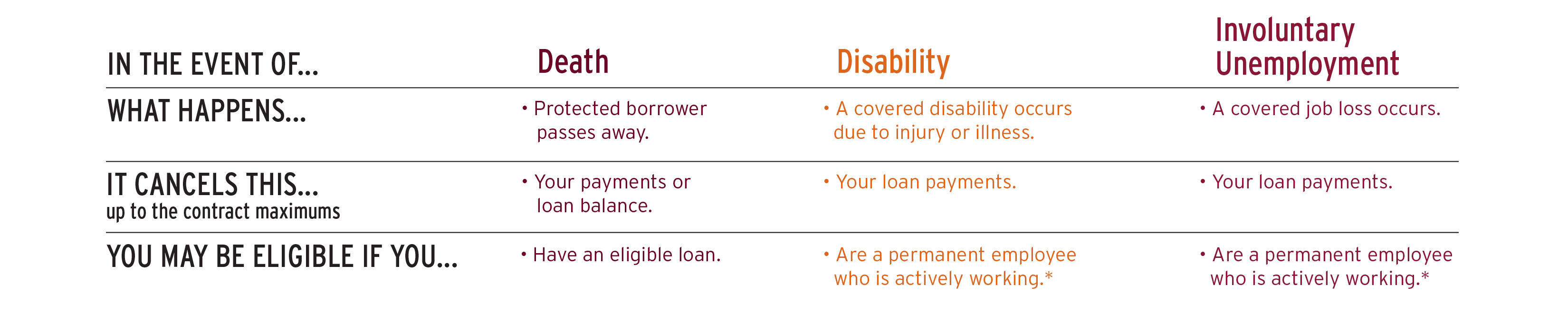

Life can be wonderful. But it can also get complicated when unexpected things happen. Protecting your loan balance or loan payments against death, disability, or involuntary unemployment could help protect your finances.

Debt Protection with Life Plus adds protection for financially-stressful life events such as accidental dismemberment, terminal illness, hospitalization, family medical leave, and the loss of life of a non-protected dependent.

This protection could cancel your loan balance or loan payments up to the contract maximums. Protect your loan payments today so you can worry less about tomorrow.

It’s simple to apply for Debt Protection with Life Plus. It’s voluntary and won’t affect your loan approval.

Call Resource One Credit Union at 800-375-3674 and ask about protecting your loan payments today.

You May Also Be Interested In

Personal Loan

Get the funds you need with simple financing terms that fit your budget.

Consolidate high-interest debt or pay for unplanned expenses. Get quick access to funds—as soon as the next business day—and enjoy low, fixed monthly payments.

Auto Loan

We provide competitive rates, quick approval, and discounts on your new or used auto loan.

No matter what type of vehicle – new or used – you’re looking to buy, we make getting the financing you need easy. With a wide selection of financing options and flexible terms, we can help you keep your monthly payments where you want them. The best place to start is getting pre-qualified.

Life Insurance by TruStage

Any amount of life insurance can make a difference and cost less than you think.

Life insurance could help give you peace of mind today and provide income-tax-free money for your family if you die. It could ease the burden of expenses you might leave behind, like funeral costs, mortgage payments, or unpaid debts.

Your purchase of Debt Protection with Life Plus is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. *Please contact your loan representative or refer to the Member Agreement for a full explanation of the terms of Debt Protection with Life Plus. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.